Credit Card Payment Form Template

Credit card payment form template - Recurring payment this template is specifically designed for recurring payments. Basic elements of a credit card authorization template. Tips for writing a hardship letter 1. In reality, the countdown starts when you miss a payment or make your last payment. So when you’ll charge a recurring payment to your. You stopped paying on the credit card debt in july 2005. For example, imagine you have a credit card you opened in 2000. Simply customize a form template and embed your customized form into your website to start accepting credit applications online. You used the account and paid as agreed for five years. The payments will be charged at the end of each billing cycle.

In 2005, something happened that changed your income and ability to make payments. A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). A recurring credit card authorization form is a document that will authorize a company to automatically deduct payment (i.e. The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder,. By providing permission for recurring payments,.

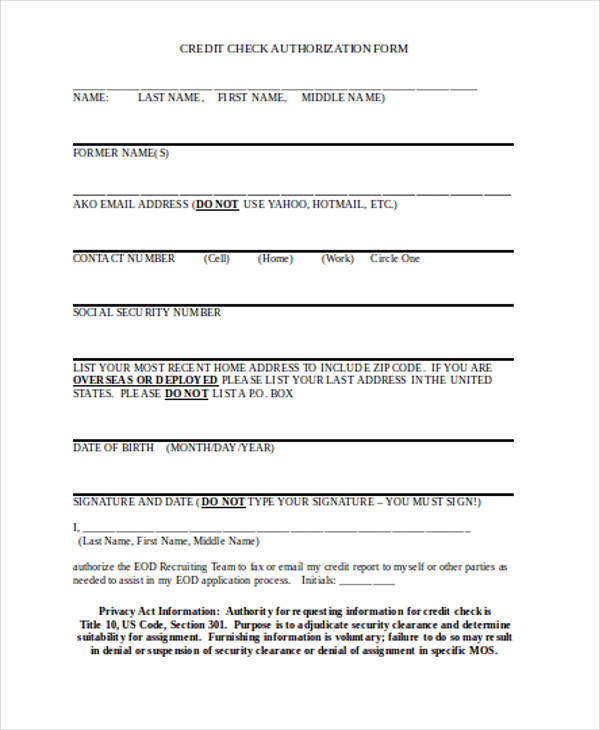

FREE 14+ Sample Check Authorization Forms in PDF MS Word

You used the account and paid as agreed for five years. Recurring payment this template is specifically designed for recurring payments. Simply customize a form template and embed your customized form into your website to start accepting credit applications online.

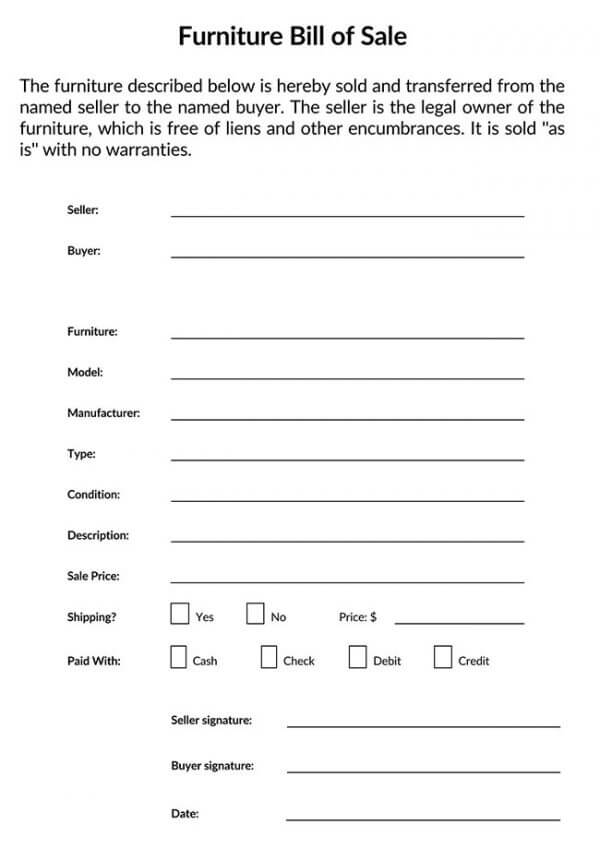

Free Furniture Bill of Sale Forms (How to Sell Used Furniture)

So when you’ll charge a recurring payment to your. Recurring payment this template is specifically designed for recurring payments. By providing permission for recurring payments,.

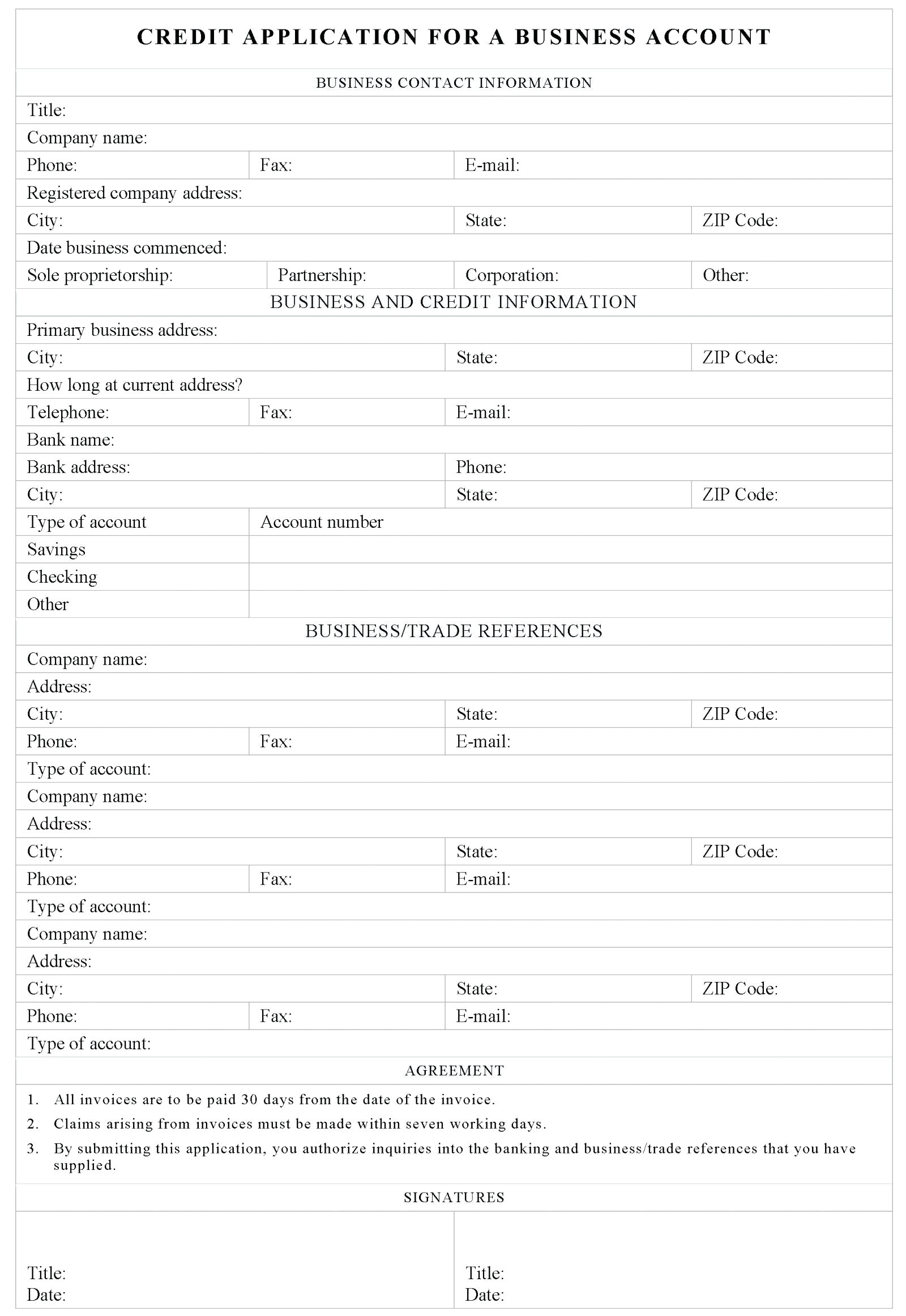

Business Credit Application Form Template Free Great Cards Nz within

Simply customize a form template and embed your customized form into your website to start accepting credit applications online. Utility bills, various subscriptions, automobile payments, etc.) from an individual’s credit card account. Basic elements of a credit card authorization template.

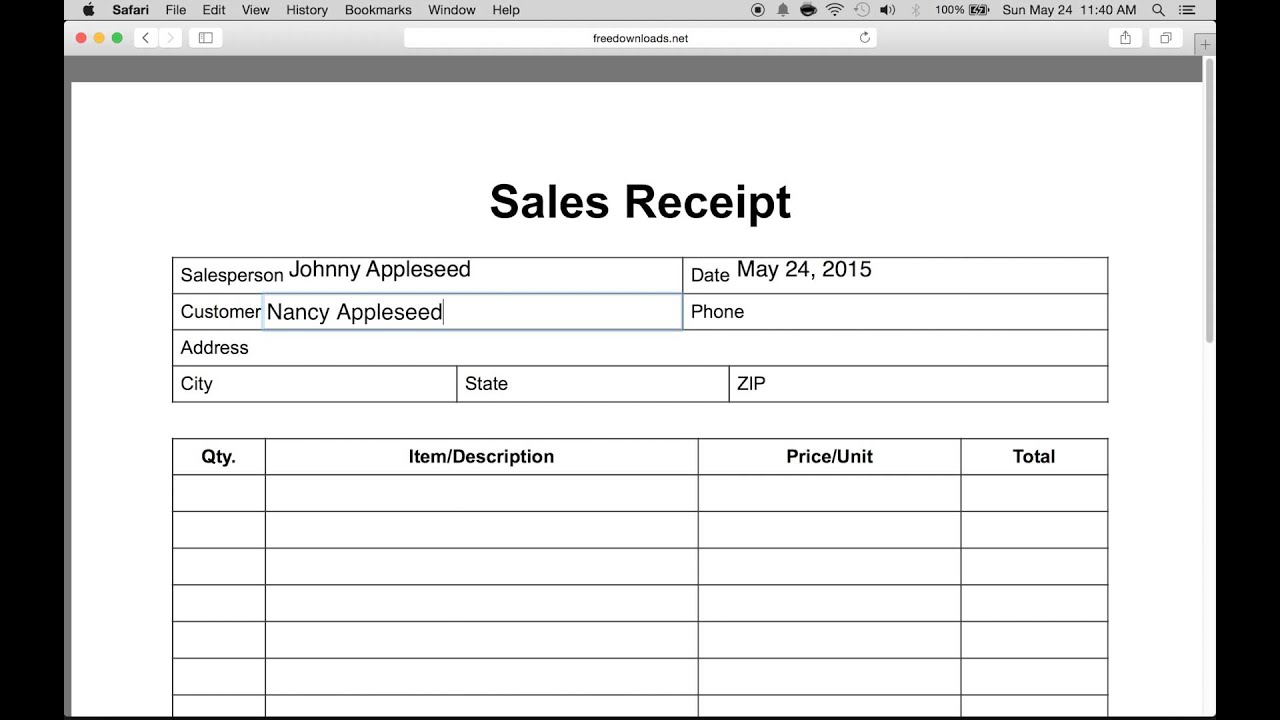

How to Write an Itemized Sales Receipt Form YouTube

For example, imagine you have a credit card you opened in 2000. In reality, the countdown starts when you miss a payment or make your last payment. By providing permission for recurring payments,.

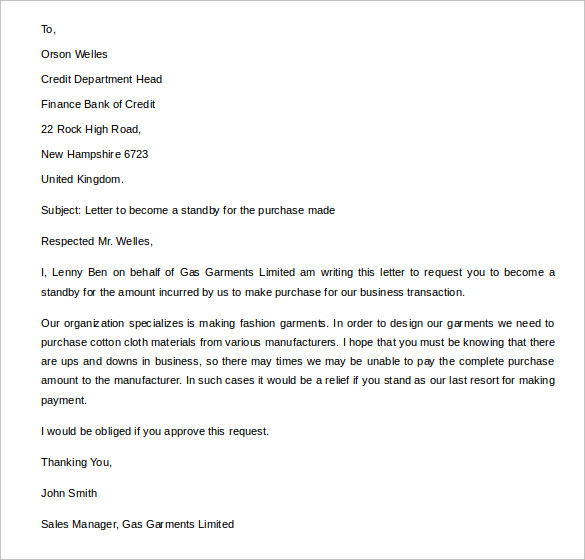

FREE 13+ Sample Letter of Credit in PDF Word

Recurring payment this template is specifically designed for recurring payments. Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt. Tips for writing a hardship letter 1.

Assumption Of Debt Agreement Sample Luxury Assignment Of Contract

Responsive credit card form built with the latest bootstrap 5. Utility bills, various subscriptions, automobile payments, etc.) from an individual’s credit card account. You used the account and paid as agreed for five years.

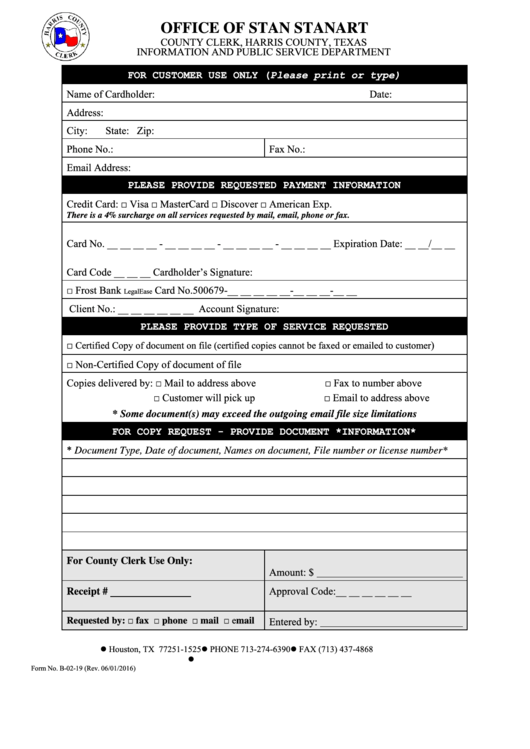

Fillable Harris County Dba Form printable pdf download

A credit card authorization form is a legal document. Responsive credit card form built with the latest bootstrap 5. The cardholder signs it to grant permission to the business to charge their debit or credit card.

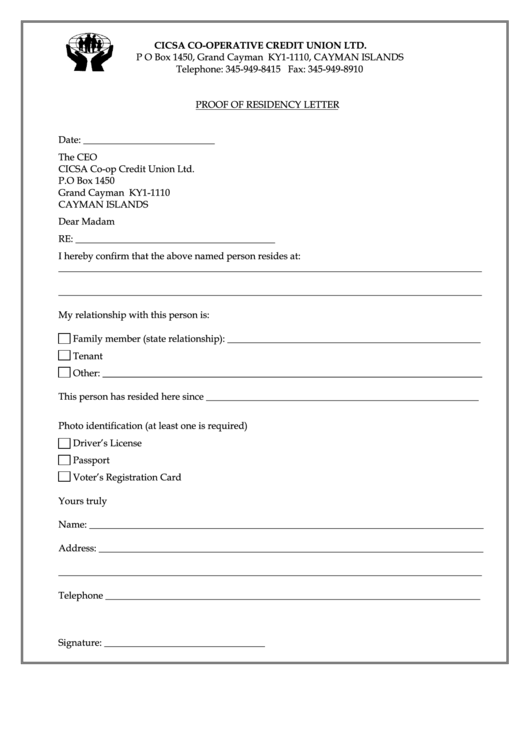

Sample Proof Of Residency Letter Template printable pdf download

You stopped paying on the credit card debt in july 2005. In reality, the countdown starts when you miss a payment or make your last payment. By providing permission for recurring payments,.

Responsive credit card form built with the latest bootstrap 5. In reality, the countdown starts when you miss a payment or make your last payment. A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the other agreed charges). You stopped paying on the credit card debt in july 2005. Basic elements of a credit card authorization template. Utility bills, various subscriptions, automobile payments, etc.) from an individual’s credit card account. By providing permission for recurring payments,. A credit card authorization form is a legal document. You used the account and paid as agreed for five years. A recurring credit card authorization form is a document that will authorize a company to automatically deduct payment (i.e.

For example, imagine you have a credit card you opened in 2000. Free payment form design template with a credit card validation example. Recurring payment this template is specifically designed for recurring payments. So when you’ll charge a recurring payment to your. The payments will be charged at the end of each billing cycle. The cardholder signs it to grant permission to the business to charge their debit or credit card. The card issuer (usually a bank or credit union) creates a revolving account and grants a line of credit to the cardholder,. Simply customize a form template and embed your customized form into your website to start accepting credit applications online. In 2005, something happened that changed your income and ability to make payments. Tips for writing a hardship letter 1.

The purpose of a hardship letter is to convey a sense of. Our credit coaches are experienced in writing letters to creditors for multiple types of hardships, including life events, credit card, and debt.