Excel Capex Template

Excel capex template - Examples of bond formula (with excel template) let’s take an example to understand the calculation of bond in a better manner. The face value of the bond is $1,000 and it is redeemable after 20 years. What is comparable company analysis? List of financial model templates. The company will raise funds for its upcoming capex plans by issuing these 10,000 deep discount bonds. Calculate the price of each bond and. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. Creating template account & depreciation base 18:38. How to summarize capex into additions categories 12:04.

Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs.

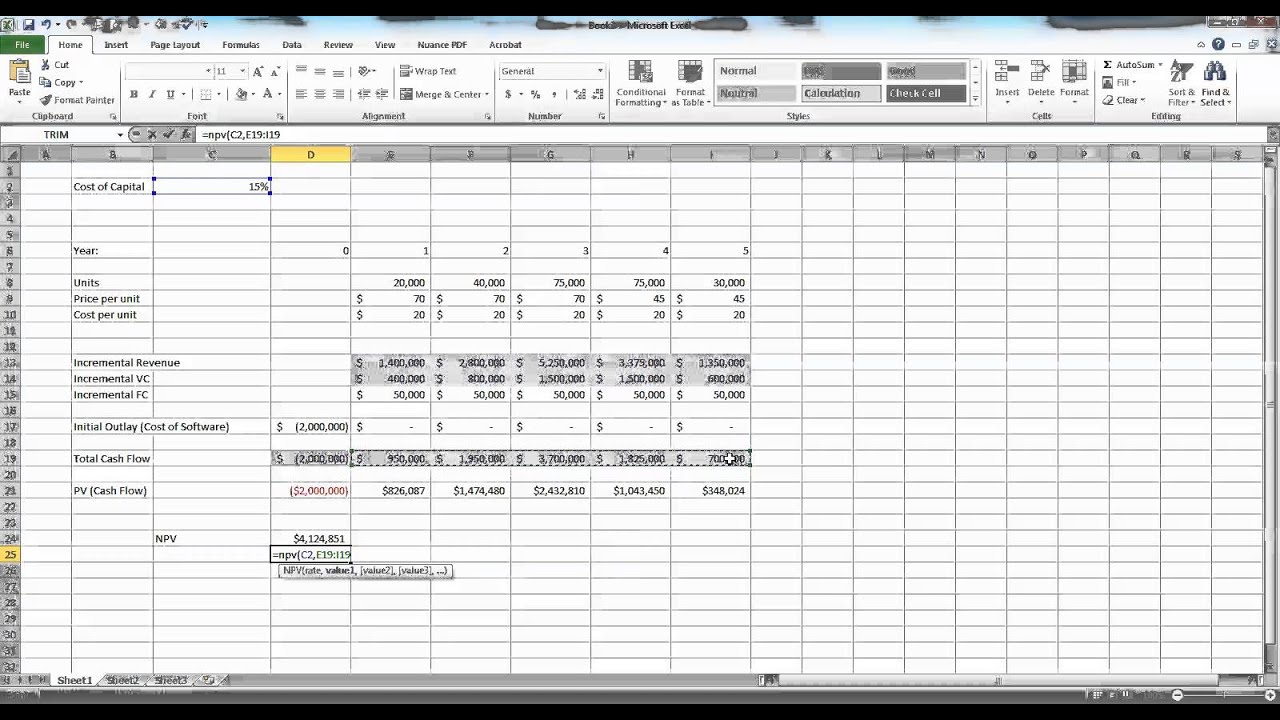

Capital Budgeting in Excel Example YouTube

What is comparable company analysis? How to summarize capex into additions categories 12:04. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation.

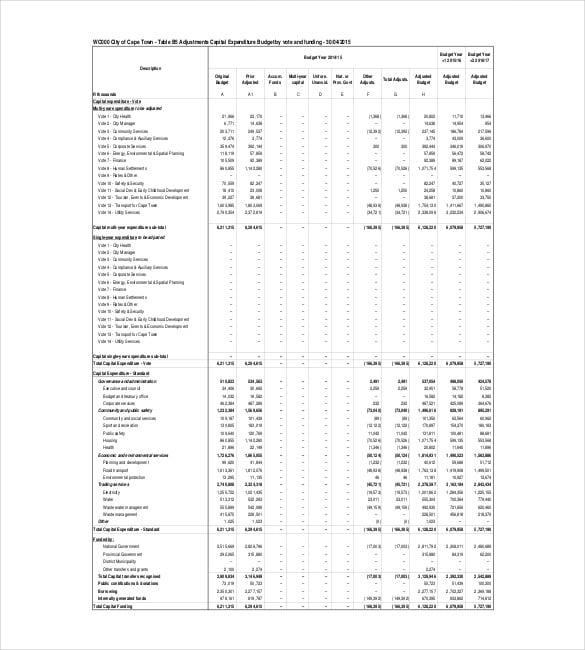

3+ Capital Expenditure Budget Template (Excel)

Creating template account & depreciation base 18:38. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business.

10+ Capital Expenditure Budget Templates Word, PDF, Excel, Google

How to summarize capex into additions categories 12:04. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. What is comparable company analysis?

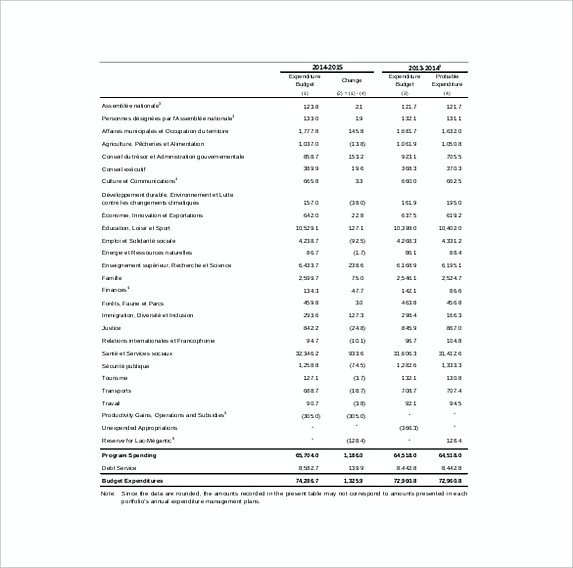

Construction Budget Template

The face value of the bond is $1,000 and it is redeemable after 20 years. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business.

Pin on Report Template

List of financial model templates. Examples of bond formula (with excel template) let’s take an example to understand the calculation of bond in a better manner. Calculate the price of each bond and.

13 Excel Budget Template Mac

The company will raise funds for its upcoming capex plans by issuing these 10,000 deep discount bonds. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation. The face value of the bond is $1,000 and it is redeemable after 20 years.

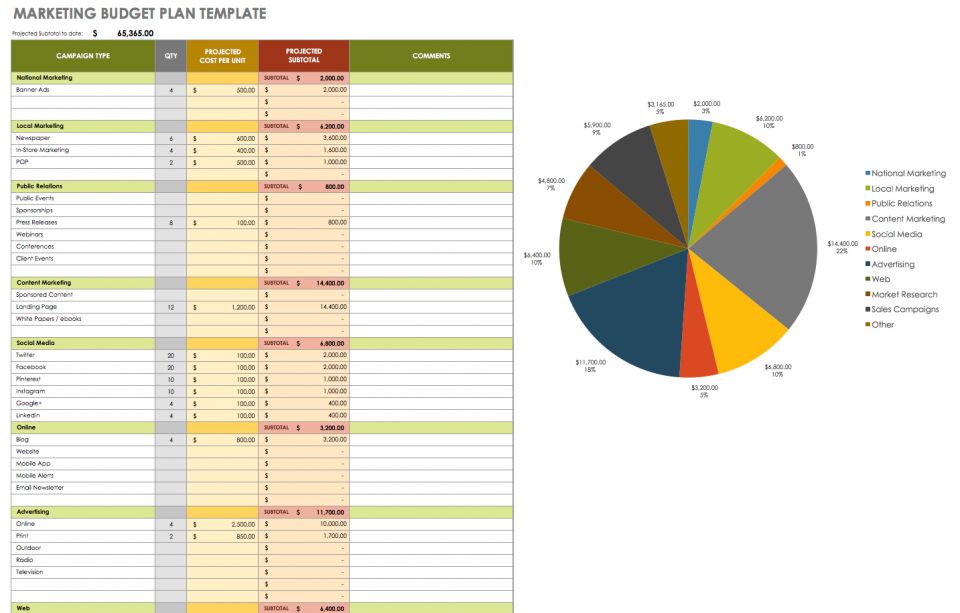

5 Basic Budget Template Excel Excel Templates

Calculate the price of each bond and. Creating template account & depreciation base 18:38. Examples of bond formula (with excel template) let’s take an example to understand the calculation of bond in a better manner.

Free Startup Plan, Budget & Cost Templates Smartsheet

Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business. How to summarize capex into additions categories 12:04. List of financial model templates.

Examples of bond formula (with excel template) let’s take an example to understand the calculation of bond in a better manner. Calculate the price of each bond and. How to summarize capex into additions categories 12:04. What is comparable company analysis? List of financial model templates. Explore and download the free excel templates below to perform different kinds of financial calculations, build financial models and documents, and create professional charts and graphs. The face value of the bond is $1,000 and it is redeemable after 20 years. Comparable company analysis (or “comps” for short) is a valuation methodology that looks at ratios of similar public companies and uses them to derive the value of another business. Creating template account & depreciation base 18:38. Comps is a relative form of valuation, unlike a discounted cash flow (dcf) analysis, which is an intrinsic form of valuation.

The company will raise funds for its upcoming capex plans by issuing these 10,000 deep discount bonds.