Irs Response Letter Template

Irs response letter template - Lightening fast transcript delivery and analysis; Use this sample complaint letter (.txt file) the next time you need to file a complaint. After you finish writing the letter, edit for typos or grammatical errors. An irs representative will first confirm your identity and from there, work with you to get you your replacement letter. Either (a) amount donated (if cash or cash equivalents); Office releases annual report on the insurance industry and request for information on potential federal insurance response to catastrophic cyber incidents. Are you unsure how to use it for your situation? October 7, 2022 treasury targets north korean fuel procurement network. Send the letter in a timely manner to keep your mortgage application on track. Request a replacement letter this is also an easy method.

Call their business and specialty tax line. Or (b) description of the property donated (the nonprofit should not attempt to assign the cash value of. Irs guidance suggests that gift acknowledgments should contain: Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity. Check out an example letter that used this format.

IRS Response Letter Template Federal Government Of The United States

You can use it as a template when you write your own letter. Use this sample complaint letter (.txt file) the next time you need to file a complaint. October 7, 2022 treasury targets north korean fuel procurement network.

10 Letter to Irs Template Examples Letter Templates

Either (a) amount donated (if cash or cash equivalents); Here’s a sample letter of explanation. Office releases annual report on the insurance industry and request for information on potential federal insurance response to catastrophic cyber incidents.

Simultaneous login of 3 users for the price of 2; Send the letter in a timely manner to keep your mortgage application on track. An irs representative will first confirm your identity and from there, work with you to get you your replacement letter.

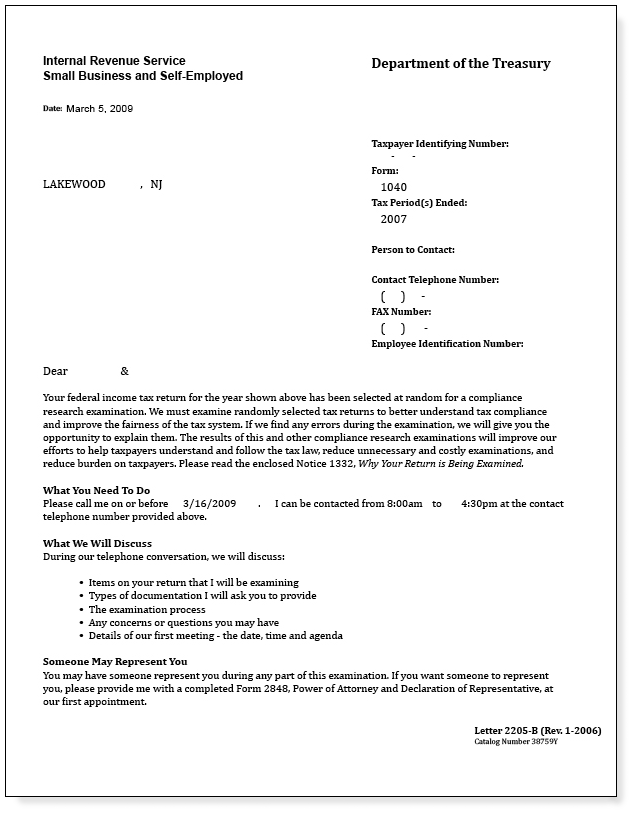

IRS Audit Letter CP22A Sample 1

Irs guidance suggests that gift acknowledgments should contain: Use this sample complaint letter (.txt file) the next time you need to file a complaint. Simply request a replacement letter from the irs.

Irs Audit Letter Sample Free Printable Documents

Simply request a replacement letter from the irs. An irs representative will first confirm your identity and from there, work with you to get you your replacement letter. Request a replacement letter this is also an easy method.

Irs Audit Notice Free Printable Documents

Or (b) description of the property donated (the nonprofit should not attempt to assign the cash value of. Here’s a sample letter of explanation. Use this sample complaint letter (.txt file) the next time you need to file a complaint.

Letter Of Resignation Notice Period RETELQ

Simultaneous login of 3 users for the price of 2; Send the letter in a timely manner to keep your mortgage application on track. This individual or entity, which the irs will call the “responsible party,” controls, manages, or directs the applicant entity and the disposition of its funds and assets.

IRS Notice CP22A Understanding IRS Notice CP22A IRS Data Processing

Call their business and specialty tax line. After you finish writing the letter, edit for typos or grammatical errors. Use this sample complaint letter (.txt file) the next time you need to file a complaint.

Here’s a sample letter of explanation. Name of contact person (if available) Irs guidance suggests that gift acknowledgments should contain: Use this sample complaint letter (.txt file) the next time you need to file a complaint. An irs representative will first confirm your identity and from there, work with you to get you your replacement letter. Request a replacement letter this is also an easy method. Send the letter in a timely manner to keep your mortgage application on track. Call their business and specialty tax line. Your address your city, state, zip code (your email address, if sending via email) date. You can use it as a template when you write your own letter.

After you finish writing the letter, edit for typos or grammatical errors. This individual or entity, which the irs will call the “responsible party,” controls, manages, or directs the applicant entity and the disposition of its funds and assets. Office releases annual report on the insurance industry and request for information on potential federal insurance response to catastrophic cyber incidents. Just enter a notice code, like cp2000, or letter number, we’ll tell you exactly what the irs needs or each case. Check out an example letter that used this format. Simultaneous login of 3 users for the price of 2; October 7, 2022 treasury targets north korean fuel procurement network. Either (a) amount donated (if cash or cash equivalents); Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity. Or (b) description of the property donated (the nonprofit should not attempt to assign the cash value of.

Simply request a replacement letter from the irs. Are you unsure how to use it for your situation? Lightening fast transcript delivery and analysis;