Ssa-44 Printable Form

Ssa-44 printable form - First date wages or annuities were paid (month, day, year). Want to file form 944 annually instead of forms 941 quarterly, check here. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter.

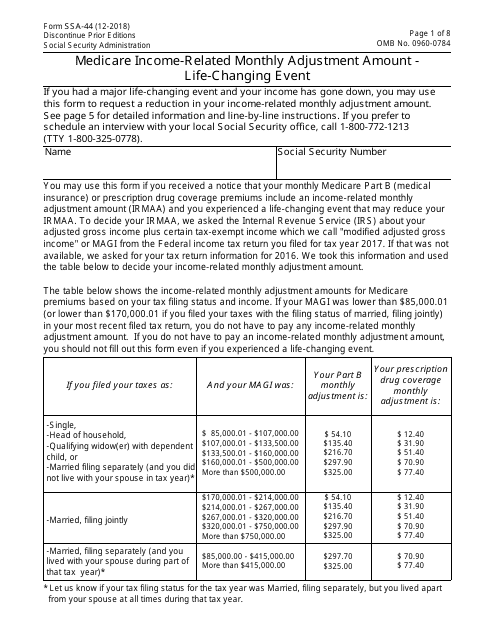

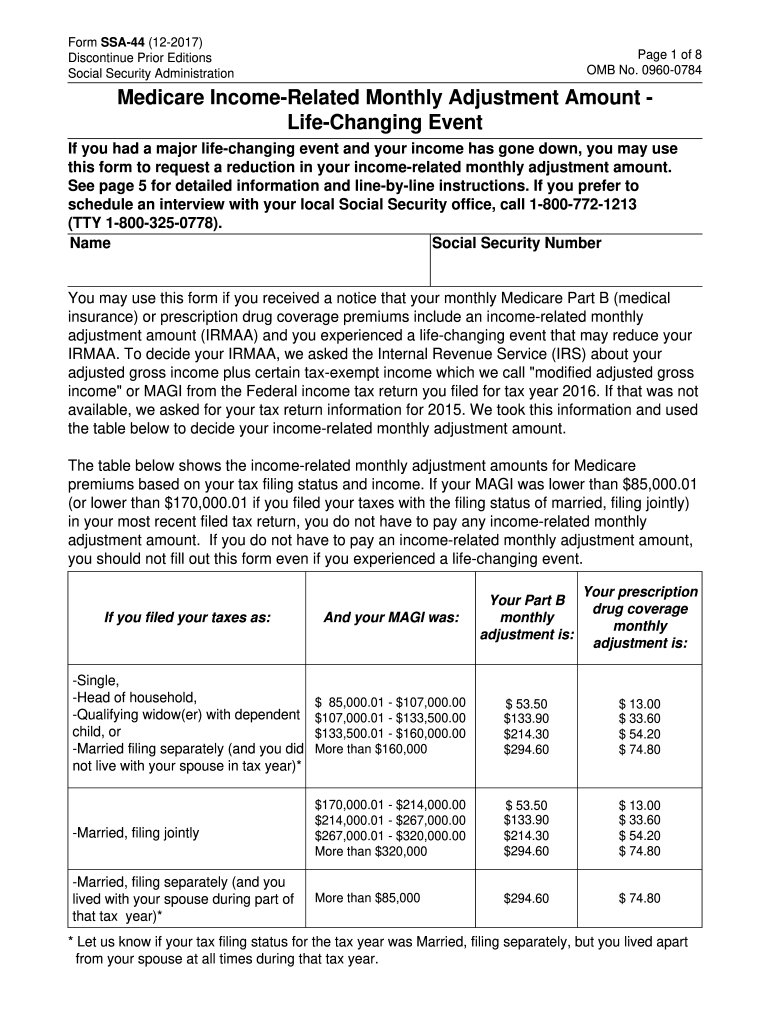

Form SSA44 Download Fillable PDF or Fill Online Medicare

Want to file form 944 annually instead of forms 941 quarterly, check here. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. First date wages or annuities were paid (month, day, year).

Higher WHY? Premiums Higher Medicare Part B doctor visits and D Rx

Want to file form 944 annually instead of forms 941 quarterly, check here. First date wages or annuities were paid (month, day, year). (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter.

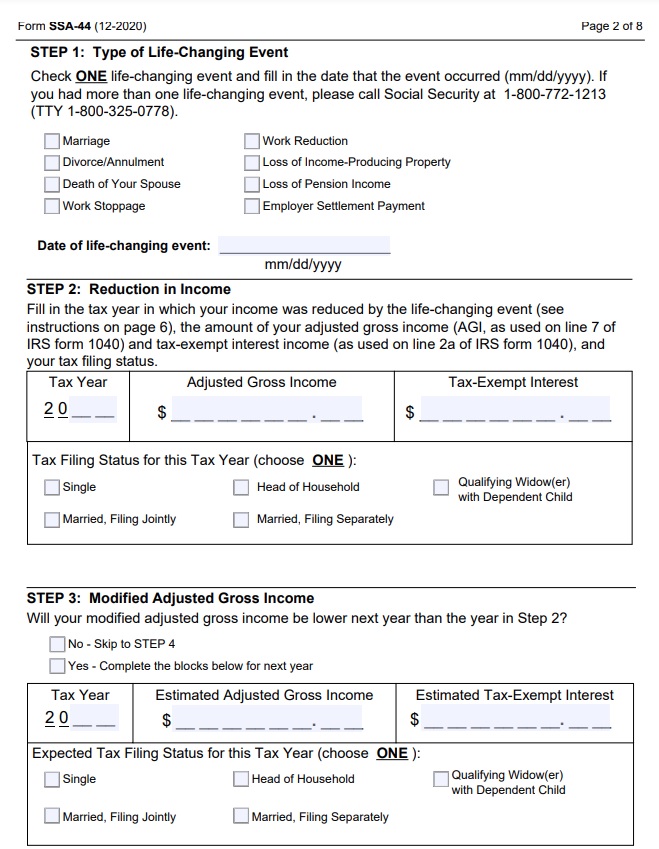

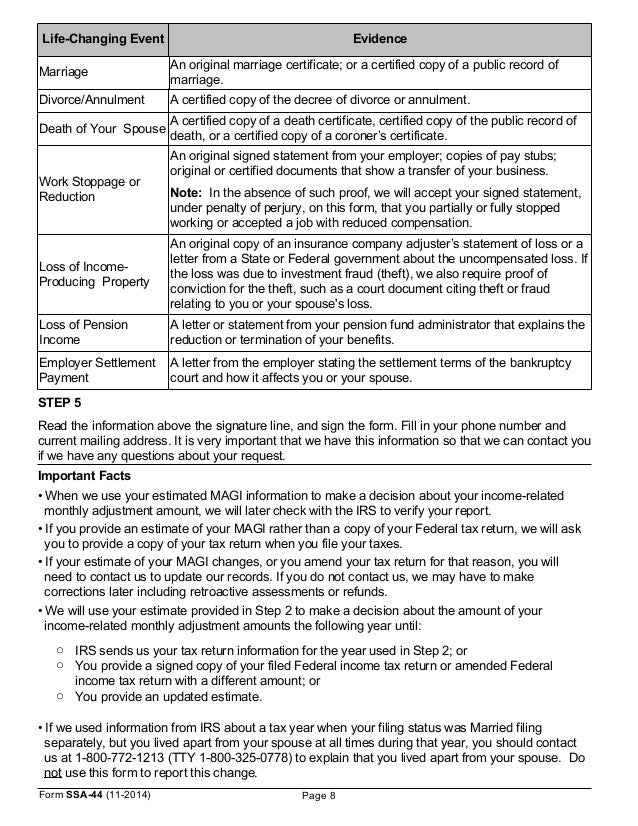

Ssa 44 Form cloudshareinfo

Want to file form 944 annually instead of forms 941 quarterly, check here. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. First date wages or annuities were paid (month, day, year).

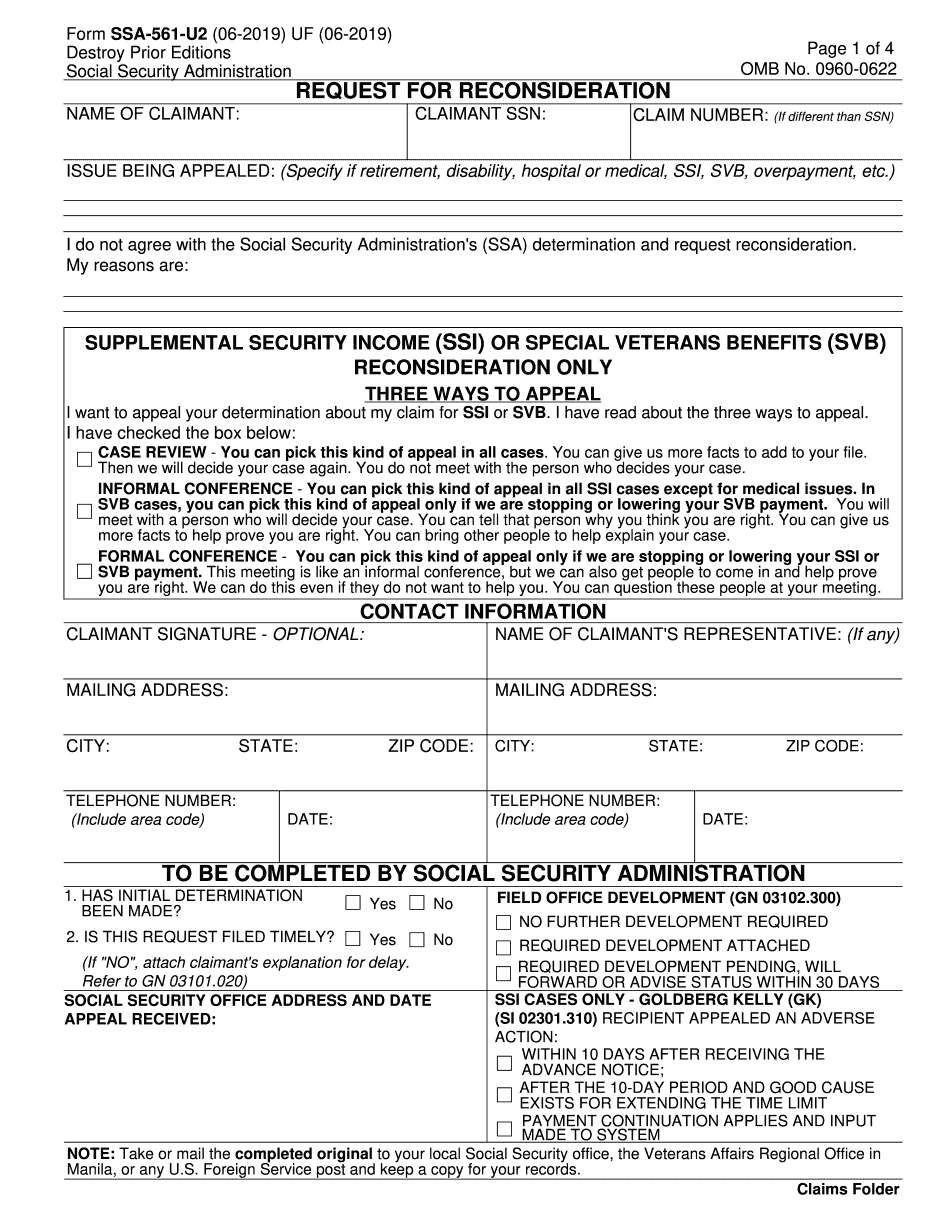

fillable form ssa3441bk Fill Online, Printable, Fillable Blank

(your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. Want to file form 944 annually instead of forms 941 quarterly, check here. First date wages or annuities were paid (month, day, year).

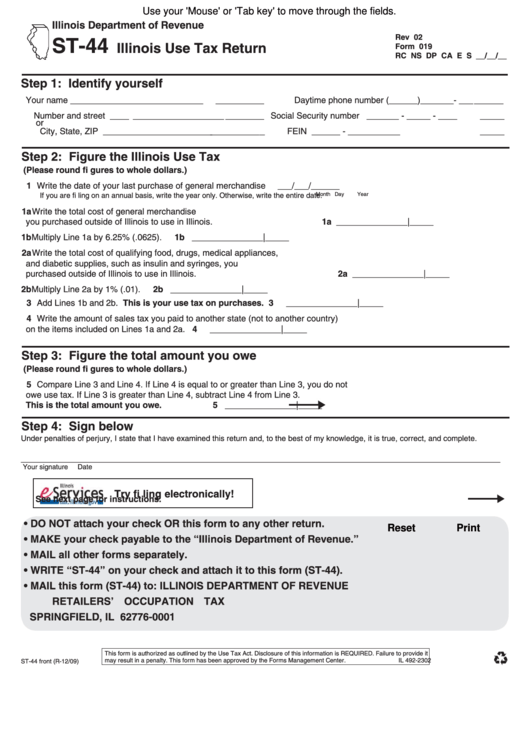

Fillable Form St44 Illinois Use Tax Return 2009 printable pdf download

Want to file form 944 annually instead of forms 941 quarterly, check here. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. First date wages or annuities were paid (month, day, year).

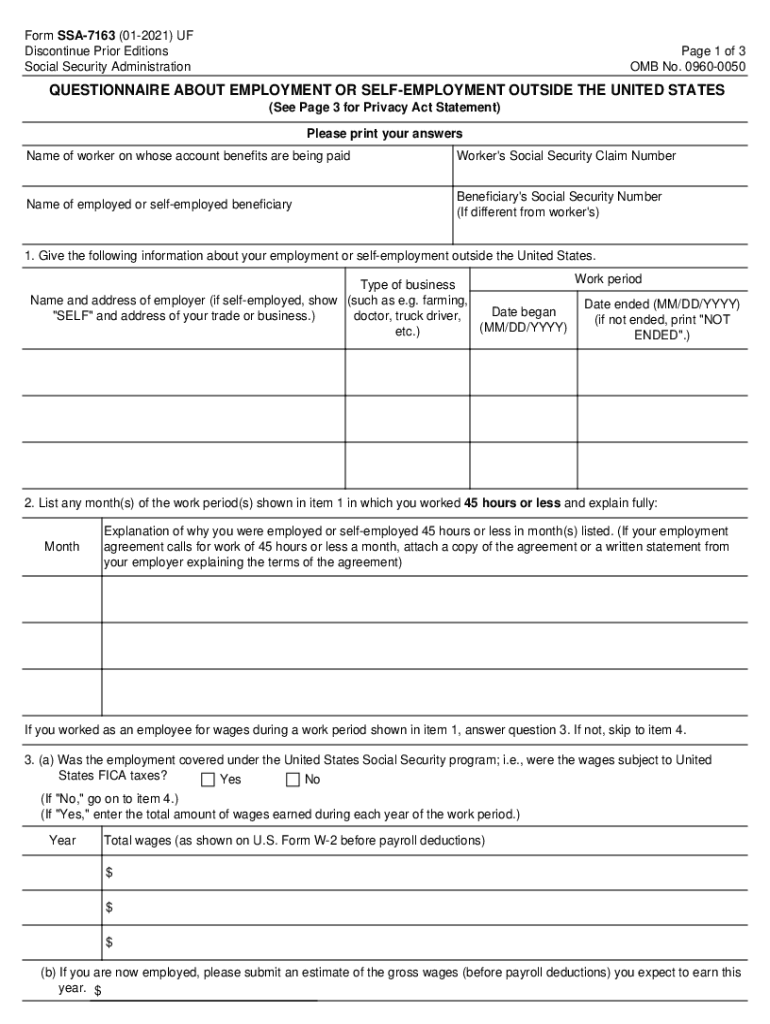

2021 Form SSA7163 Fill Online, Printable, Fillable, Blank pdfFiller

First date wages or annuities were paid (month, day, year). Want to file form 944 annually instead of forms 941 quarterly, check here. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter.

Ssa 44 Form cloudshareinfo

Want to file form 944 annually instead of forms 941 quarterly, check here. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. First date wages or annuities were paid (month, day, year).

20172020 Form SSA44 Fill Online, Printable, Fillable, Blank pdfFiller

First date wages or annuities were paid (month, day, year). (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. Want to file form 944 annually instead of forms 941 quarterly, check here.

Form SSA44 Edit, Fill, Sign Online Handypdf

Want to file form 944 annually instead of forms 941 quarterly, check here. (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. First date wages or annuities were paid (month, day, year).

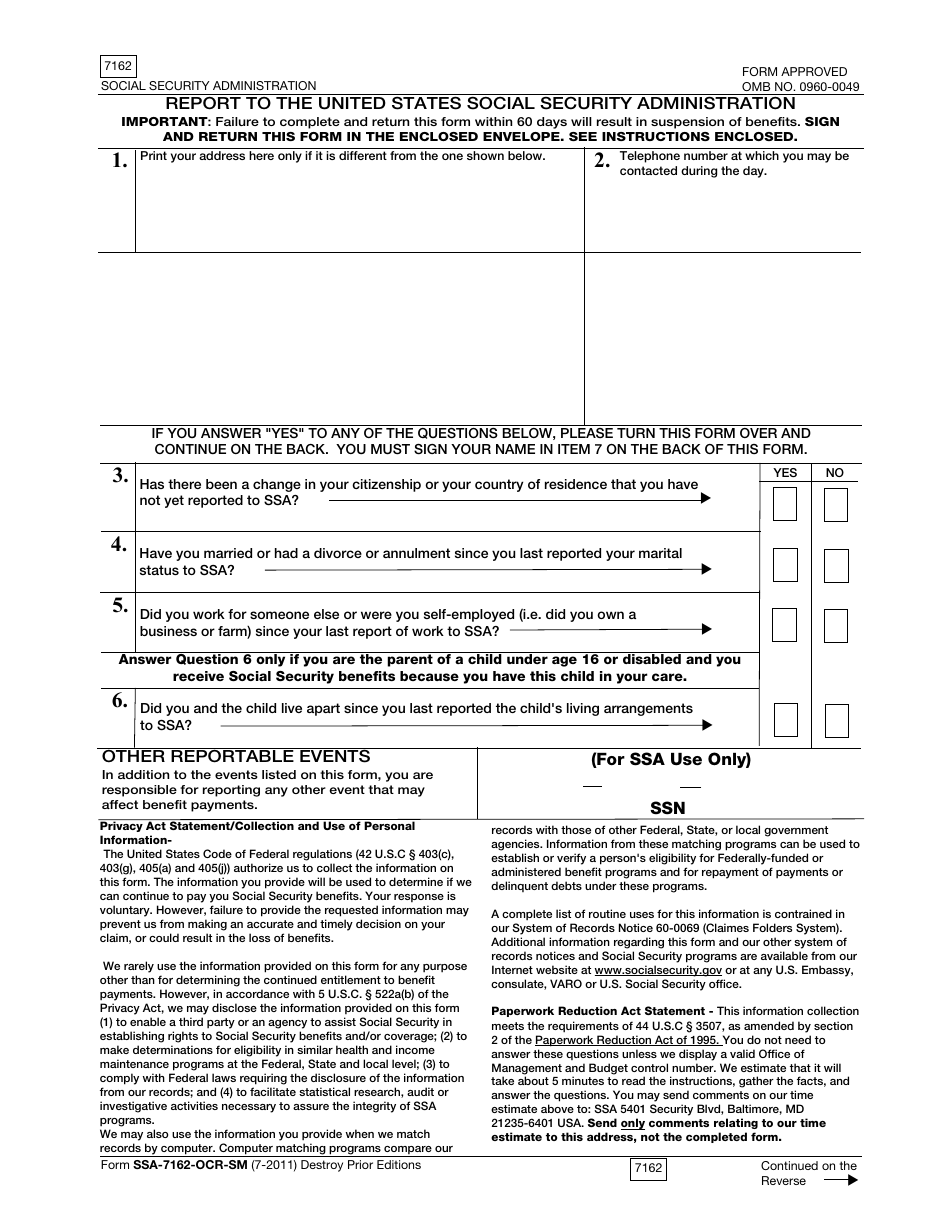

Form SSA7162OCRSM Download Fillable PDF or Fill Online Report to the

First date wages or annuities were paid (month, day, year). (your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. Want to file form 944 annually instead of forms 941 quarterly, check here.

(your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) if you don’t check this box, you must file form 941 for every quarter. First date wages or annuities were paid (month, day, year). Want to file form 944 annually instead of forms 941 quarterly, check here.